How AI Budgeting Can Help You

Tailored for Every Financial Journey

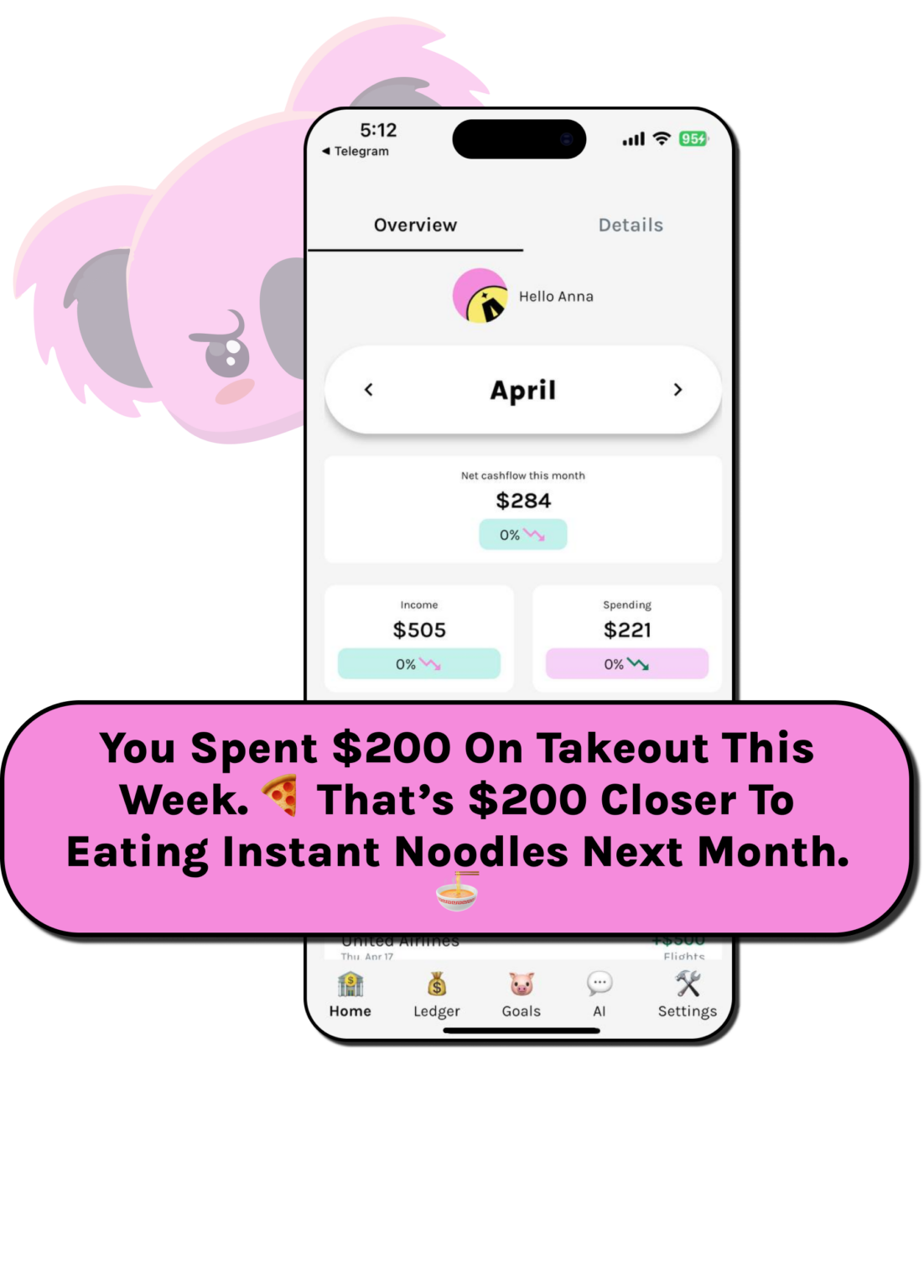

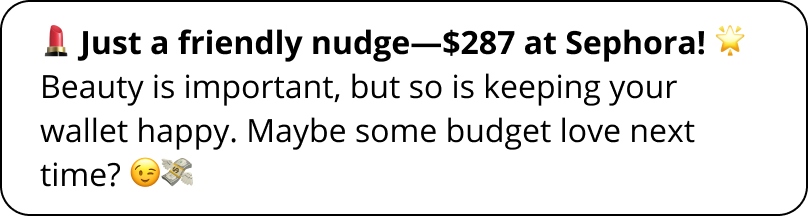

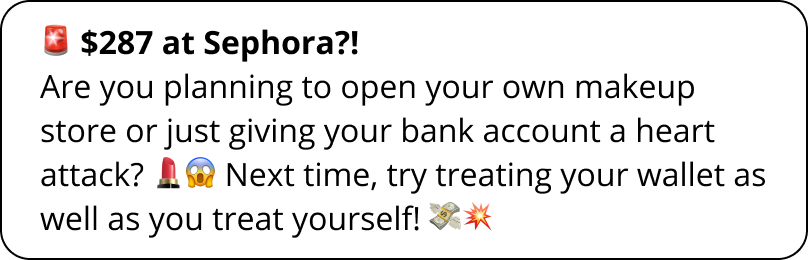

Avoid Overspending

Got a weakness for a particular store? (Looking at you, Kmart shoppers!) Asper can keep an eye on your habits and nudge you to rein it in.

Master Budgeting

Set spending limits, track categories, and let our AI guide you toward smarter decisions—no spreadsheets required

Pay Off a Loan Faster

Slash unnecessary expenses and clear your debt sooner

Prepare for a Mortgage

Ready to buy your dream home? Asper helps you cut unnecessary expenses and track your savings progress, so you can boost your creditworthiness and reach your deposit goal faster

Save for Something Big

Whether it’s a wedding, holiday, or just an emergency fund, we’ll help you create a plan to stick to your goals.

Refinance with Confidence

Planning to refinance your loan? We’ll help you identify areas to trim spending, freeing up extra cash to improve your financial position.

How It Works

🔗 Connect your bank account

to our AI buddy. No judgment…yet.

🤐 Pick your honesty level

from “polite suggestions” to “brutal truths.”

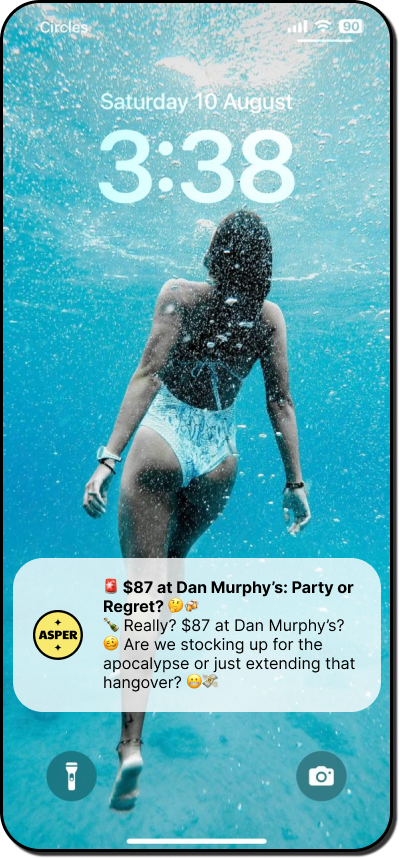

💸 Every time you spend

expect a fun (or savage) notification.

😇 Adjust your habits and save 💸

without feeling too guilty

Meet Asper

She isn’t your average budgeting tool.

She’s a pink, mildly-angry koala who’s had enough of your “just this once” purchases and “it was on sale” excuses. She sees your impulse buys. She hears your “new year, new budget” lies.

And she’s not here to coddle you, she’s here to save you from yourself.

“Another $19 on bubble tea? Bold of you to assume you can afford joy.” – Asper

Built with AI smarts and a roast-first attitude, Asper calls out your worst habits, celebrates your wins (reluctantly), and keeps your spending in check — all while being kind of adorable (in a terrifying way).

Your AI CoPilot. Your Rules.

Adjust your AI’s vibe with our honesty scale! Whether you’d like a gentle ‘Nice choice!’ or a playful nudge for that pricey avocado toast 🥑, you’re in control. 💬

Soft & Polite 🔁

🔁 Savage Roast

Your Data, Safe and Secure

We don’t store your financial data. We read and react.

Asper prioritizes your privacy and security, protected by industry-leading protocols and compliant with all U.S. privacy standards.

We access your data only with your explicit consent, ensuring it’s used responsibly and never shared without your permission. Trust us to keep your transactions and financial information safe and secure

What people say 📣

What people think of Asper

⭐️⭐️⭐️⭐️⭐️

“I’ve always known I was a reckless spender, but most budgeting apps made me feel like I was being scolded by a disappointed parent. Asper was the first app that actually got me. Instead of boring pie charts, it hit me with hilarious roast notifications that made me want to fix my habits without feeling guilty. In just three months, I went from paycheck-to-paycheck panic to having an emergency fund for the first time in my life. Asper doesn’t just track your money — it changes how you think about spending.”

— Jess M., 27

⭐️⭐️⭐️⭐️⭐️

“If Asper existed five years ago, I would have saved thousands by now. No exaggeration. The AI is so clever — it even warned me when I started browsing expensive flights during a rough week at work. Instead of a boring budget alert, I got a hilarious roast that made me close the tab immediately 😂 It’s hands down the most effective financial tool I’ve ever used because it feels human. You don’t need to be a finance nerd to love Asper.”

— Sara K., 23

⭐️⭐️⭐️⭐️⭐️

“I was skeptical at first because ‘funny budgeting app’ sounded like an oxymoron. But Asper is genuinely brilliant. It’s smart enough to catch when I’m about to make a dumb online purchase and savage enough to make me laugh instead of buy. The Spending Personality Test nailed me so accurately it was scary (hello, Subscription Hoarder). Now I’ve cleaned up my finances without feeling like I’m living in constant restriction. If you hate traditional budgeting apps, this is the one.”

— Marcus P., 32

⭐️⭐️⭐️⭐️⭐️

“I used to call myself a ‘good saver’ — but Asper exposed how much of my money was leaking through tiny, dumb purchases. The roast notifications, the checkout warnings, even the monthly ‘Spending Personality’ feedback — all of it combined made me more mindful without making me miserable. Asper turned something that used to feel like punishment (budgeting) into a game I actually enjoy playing. Best part? No judgment, just hilarious reality checks.”

— Daniel F., 39

⭐️⭐️⭐️⭐️⭐️

“Every budgeting app I tried before Asper either overwhelmed me with data or made me feel bad for not being perfect. Asper is the first app that felt like a realistic money coach — one that understands humans aren’t robots. I love the little nudges it gives when I’m about to overspend, and the Spending Personality insights helped me realise I wasn’t ‘bad at money’ — I just had terrible habits I never questioned. Asper made saving feel empowering, not shameful.”

— Ethan L., 30

⭐️⭐️⭐️⭐️⭐️

“Most apps are reactive — they tell you you’ve overspent after the damage is done. Asper is proactive. It’s like having a brutally honest best friend who grabs your phone out of your hand when you’re about to make a bad decision. I love the feeling of catching myself mid-spend, laughing at the roast, and actually feeling good about not buying something dumb. In just 90 days, I’ve saved over $600 just by making smarter daily decisions. Asper isn’t just a budgeting app — it’s a mindset shift.”

— Mom W., 24

⭐️⭐️⭐️⭐️⭐️

“The moment Asper roasted me for ‘emotionally adopting’ a cart full of skincare I didn’t need, I knew this app was different. It’s funny, yes, but also shockingly effective. It helps you catch bad habits before they snowball. Plus, the simple layout means you actually want to check in every day, even just for the laugh. Asper helped me save almost $800 in two months just by making me pause and rethink my mindless online shopping.”

— Priya S., 24

⭐️⭐️⭐️⭐️⭐️

“At first, I downloaded Asper as a joke after seeing a meme about it. I honestly didn’t expect it to change how I spend. Fast forward three months and I’m shocked at the difference. Asper caught my worst impulses before they turned into $200+ shopping sprees. Plus, the roast-style notifications somehow manage to be brutal and encouraging at the same time. It’s the only app that’s ever made me laugh and save money. I recommend it to every friend who says ‘I’m bad with money.'”

— Lily R., 26

Pricing

Everyone’s financial habits are different, so we’ve created two pricing plans for you to pick from. Find the one that fits you best!

FREE

🔗 Bank Integration

Sync your accounts for real-time tracking

🎯 Goals

Set and track basic savings goals

🤖 AI Insights

Smart spending analysis

🔥 Roasts

Get called out for bad spending habits

$4.99/m

🎯 Extra Goals

Set savings targets per merchant

🔔 Custom Notifications

Personalised spending alerts

👨💼 Regular transaction analysis

Get expert guidance

FAQ

What is Asper?

Asper is an AI-powered budgeting app that helps you spend smarter by tracking your transactions, setting spending goals, and—unlike boring finance apps—roasting your bad spending habits to keep you accountable.

How does Asper work?

We sync with your bank accounts to analyze your spending in real time. Our AI then provides insights, notifications, and even a bit of tough love to help you stay on track with your financial goals.

Is my financial data secure?

Absolutely. We take data security very seriously. We don't save your transaction data, and we never sell your personal information. Some anonymized data is processed using OpenAI for smarter insights, but your privacy always comes first.

What makes Asper different from other budgeting apps?

Unlike traditional budgeting apps that just show you numbers, we actively hold you accountable. Our AI sends real-time spending warnings, goal updates, and humorous roasts to keep you engaged with your money.

Can Asper help me stop impulse spending?

Yes! If you struggle with swiping before thinking, Asper is perfect for you. We track your transactions and nudge you when you're close to your budget limit.

Does Asper connect to my bank?

Yes! We securely connect to your bank accounts to provide real-time tracking and smarter insights into your spending habits.

What happens if I go over my budget?

You’ll get a reality check from our AI (possibly with some light roasting). Plus, we’ll suggest small changes to get you back on track before your finances spiral.

Can I customize my spending goals?

Of course! You can set custom spending limits and savings goals, and our AI will keep you updated on your progress.

How do I get started?

Simple! Download Asper, connect your bank accounts, and let our AI help you take control of your spending—one roast at a time.

We would like to acknowledge the Gadigal people of Eora Nation, as traditional owners of the ancestral lands on which our premises stand. We recognise Aboriginal and Torres Strait Islanders as the first peoples of Australia and pay our respects to their Elders past, present and emerging.

© 2025 Moneta Lend. All rights reserved